how do i pay my personal property tax in richmond va

804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. If the information shown is incorrect press the Return to Search button.

/cloudfront-us-east-1.images.arcpublishing.com/gray/WPM3BLSOYBGB7DP3Q4DS2QXRUU.png)

Chesterfield Provides Grace Period On Personal Property Tax Payments

Tax rates differ depending on where you.

. On the first screen enter your email address and then press OK. Once you have created an account you will be able to login and view your property tax bill. Directly from your bank account direct debit ACH credit initiated from your.

Search Valuable Data On A Property. Free Case Review Begin Online. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

Start Your Homeowner Search Today. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

To pay your personal property tax in Virginia you can either mail in a check or money order with your payment coupon to the Commissioner of the Revenues office or pay. Such As Deeds Liens Property Tax More. You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website.

How do I pay my personal property tax in Richmond VA. Based On Circumstances You May Already Qualify For Tax Relief. Click on Continue to Pay Personal Property Taxes link at the top or bottom of this page.

Based on the type of payment s you want to make you can choose to pay by these options. Taxpayers can either pay. To pay the current Personal Property bill only or to add a bill using another Web application press the Checkout button.

Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and. How Do I Pay Personal Property Taxes. You will then need to enter your payment information and submit your payment.

Ad See If You Qualify For IRS Fresh Start Program. Ad Get In-Depth Property Tax Data In Minutes. When do I need to file a personal property return for my car or pickup.

You can call the Personal Property Tax Division at 804 501-4263 or visit the Department of Finance website. If you can answer YES to any of the following questions your vehicle is considered by. Personal property tax bills have been mailed are available online and currently are due June 5 2022.

100s of Top Rated Local Professionals Waiting to Help You Today. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL.

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

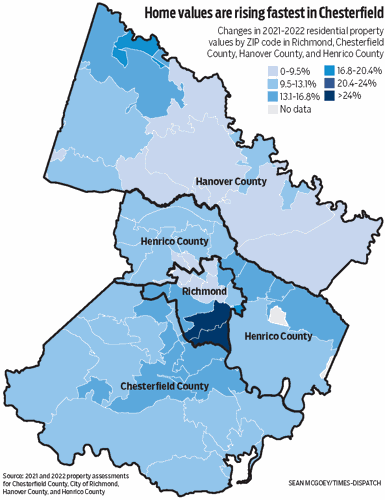

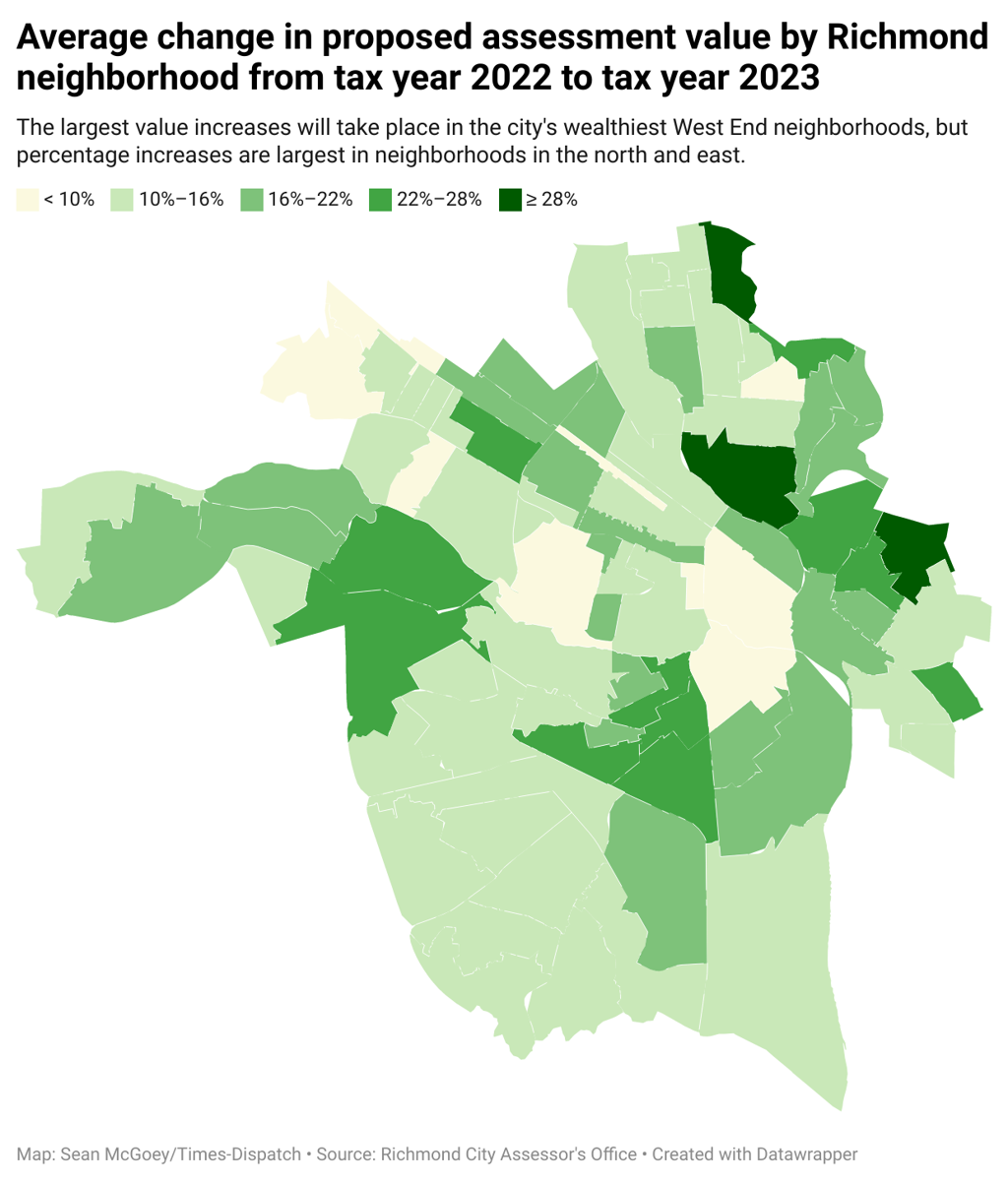

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Pay Online Chesterfield County Va

7110 University Dr Richmond Va 23229 Mls 2223717 Redfin

3129 Park Ave Richmond Va 23221 Realtor Com

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Cost Of Living In Virginia 2022 Sofi

How To Reduce Virginia Income Tax

Check Yes For Henrico Va Presentation For Henrico County Residents And Civic Groups April Ppt Download

Check Yes For Henrico Va Presentation For Henrico County Residents And Civic Groups April Ppt Download

Pay Personal Property Tax Help

Virginia Property Tax Calculator Smartasset

Treasurer Chesterfield County Va